China seeks to displace the IMF as the world's largest creditor

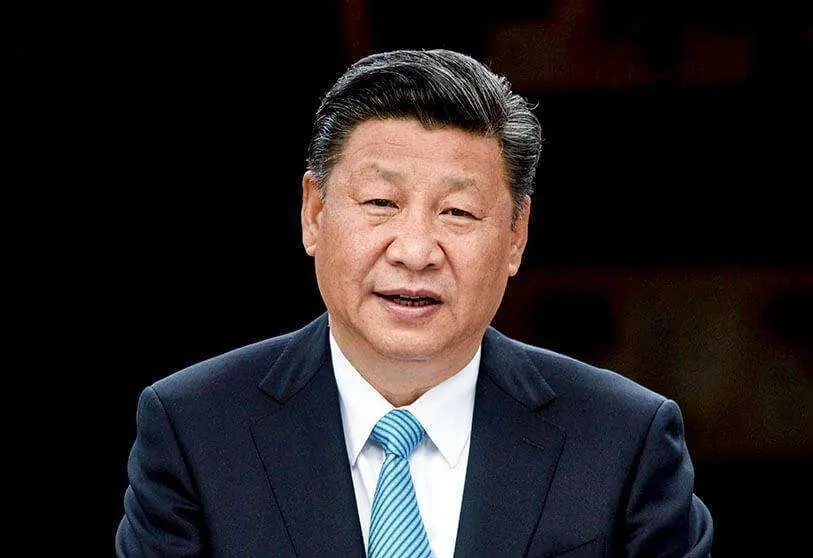

Nancy Pelosi's recent visit to Taiwan sparked an angry response from Beijing, which saw the US House of Representatives speaker's trip as a clear challenge to its 'one China' policy, one of the key projects of Chinese President Xi Jinping's term in office. Beijing then decided to break off bilateral cooperation in several areas, in force since the arrival of Joe Biden in the White House. The threats of a total rupture that have been repeated in recent hours, although predictable, are evidence of the bitter struggle for hegemony between the United States and China, a rivalry that has spilled over into the financial sphere.

In the last decade, Beijing has become one of the world's main creditors. Since 2010, the Chinese government has tripled its loans, which mainly assist underdeveloped or developing countries through the New Silk Road Initiative (BRI), becoming a direct competitor of organisations such as the International Monetary Fund (IMF) and the World Bank (WB). The Asian giant does not have the same constraints as these two institutions, and can afford to set its own rules.

More than five years ago, Chinese President Xi Jinping, nicknamed 'The Great Helmsman 2.0' after Mao Zedong, announced his key project: the New Silk Road. Beijing has invested close to a trillion dollars, the equivalent of eight 'Marshall Plans', which has become the vehicle through which it installs itself in other economies in the region. And not only in the region.

The IMF puts on the table a series of economic recipes that must be implemented by states if they want to receive its help. The famous structural reforms, labelled by critics as draconian and harmful. Meanwhile, China assists through infrastructure projects on the sole condition that they are built by Chinese companies, which 'a priori' grants greater independence to debtor countries. However, Beijing tends to lend at higher interest rates and impose a shorter repayment period. It also uses loans as a tool of pressure, in exchange for natural resources or geopolitical favours.

Beijing claims that there has been no case of any debtor country with China falling into the so-called "debt trap", i.e. lending funds to other states with the aim of controlling their key assets if the latter is unable to repay the debt.

Around 60 per cent of China's external lending goes to countries currently facing severe debt crises, according to World Bank researchers. The economic crisis triggered by Russia's invasion of Ukraine is in turn causing an outflow of foreign currency from developing countries that are part of the Silk Road Initiative, raising the risk of debt default. The most prominent cases are Pakistan, where Chinese investment amounts to 62 billion dollars - approximately one-fifth of Islamabad's GDP - and Sri Lanka, a country in chaos after defaulting, to which China has committed more than 32 billion dollars.

Overall, China operates as an increasingly viable alternative to the IMF, although it still faces a number of constraints. Unlike the IMF, its funds are currently not sufficient to replace the IMF. Nor is its action limited to following in the footsteps of the US and France, which have offered similar assistance to favoured states. China's approach to bailouts is more of a continuist attitude than a break with the West: concern for repayment rules, but it is interchangeable for geopolitical gain.