Europe facing energy crisis: soaring prices "well into 2023"

Natural gas prices have reached an all-time high in the third quarter of the year. The situation is critical. Far from abating, the price rises are constant due to the shortages caused by the Kremlin's supply cuts. Gas as a tool of pressure: this is how Moscow has taken advantage of Europe's energy dependence to tighten the screws within the EU-27. There are cracks. At least 40% of the gas consumed by member states in 2021 came from Russia. Brussels is now speeding up the process of energy disconnection to reduce this percentage.

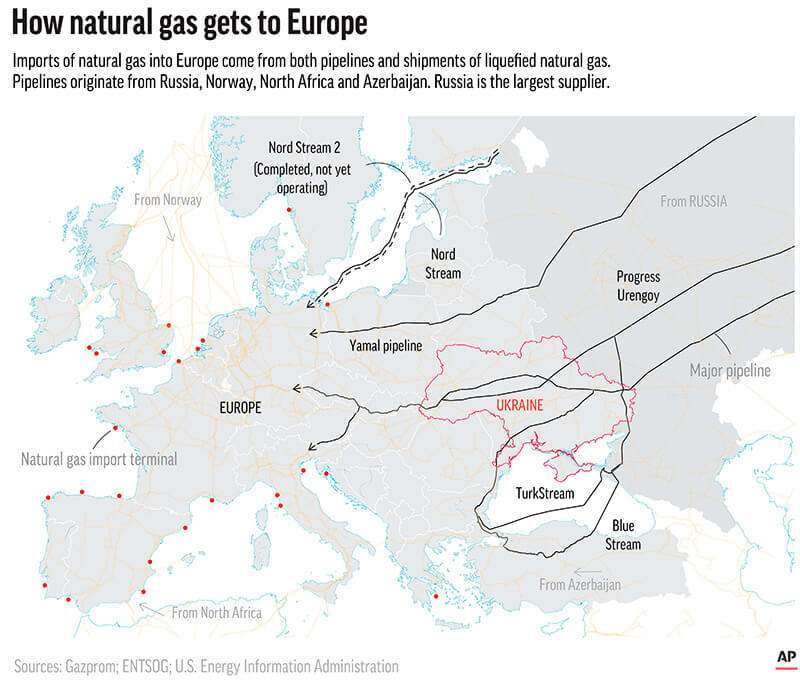

Russian gas, however, continues to arrive in dribs and drabs. It comes via Slovakia, the Black Sea, Turkey and Bulgaria. Until just a few weeks ago, it also came via the Baltic Sea, before the Nord Stream 1 and 2 pipelines were sabotaged, which has led to an escalation of tensions in the region. Around 80% of the supply even comes via the Yamal-Europe, Brotherhood or Soyuz pipelines, which pass through Ukraine. So far they have not stopped despite the war and Gazprom's threats on Naftogaz, the Ukrainian state energy company. But it is likely to happen in the coming weeks.

— Gazprom (@GazpromEN) September 28, 2022

Germany, the eurozone's largest economy, is in the grip of Russian gas. Its industry depends on supplies flowing at the usual rate, a need that is of course not being met in this context. In Berlin, as is evident, a climate of nervousness has set in that has been paralysing the executive. Inflation is running rampant, in fact, it is the highest in 70 years and exceeded 10% in September, according to Eurostat data. Only Belgium has worse figures in the EU. Fears of a more than likely recession continue to set the agenda.

German Chancellor Olaf Scholz seems to have taken the initiative after weeks of inaction with the announcement of the anti-crisis plan. The tripartite government, which is at its lowest ebb since it succeeded former chancellor Angela Merkel a year ago, will push through a 200 billion euro consumer fund to compensate for the exorbitant level of energy spending. Around 5% of its GDP. The rest of the member states are proposing similar measures to weather the storm.

The European Commission has also taken action. Decisions related to the expansion of storage, energy savings and the search for new export partners stand out. The EU executive has found solutions, although there is still a crisis to be resolved. With storage tanks more than 80% full by October, policies to reduce consumption in place and new energy alliances with countries such as Norway, Qatar and Azerbaijan - although the latter has been severely criticised for war crimes committed by its army against Armenian soldiers - the EU has caught its breath. But it is not enough.

Ursula von der Leyen's Commission proposed in early September to cap Russian gas prices. However, several member states raised reservations about possible retaliation by the Kremlin. Brussels then called for the measure to be interpreted in the same way as other sanctions imposed against Russia since the beginning of the invasion of Ukraine, but the debate began to fade. Until last Thursday, when Energy Commissioner Kadri Simson resurrected a proposal that seems to be taking shape again.

In this scenario of instability, the publication of the latest quarterly report by the International Energy Agency (IEA) has gained importance. The agency, created by the Organisation for Economic Co-operation and Development (OECD), recommends that the European Union reduce energy consumption by 9% in order to survive the coming winter with some margin. A reduction, therefore, of around 13%.

Keisuke Sadamori, Director of Energy Markets and Security, predicts that the markets will remain under stress "well into 2023". Experts therefore predict that prices will continue to soar in the coming months. A drop in the medium term is ruled out.

"Europe's liquefied natural gas (LNG) imports are expected to increase by more than 60 billion cubic metres (bcm) this year, more than double the amount of global LNG export capacity additions, keeping international LNG trade under strong pressure in the short to medium term," the IEA projects. However, consumption would decline by 0.8% in 2022, with a record contraction in Europe, according to the agency's forecast.

The IEA report contains an analysis of the resilience of the EU energy market in a scenario of complete supply cuts from 1 November. The conclusions reached by the experts are clear: storage would be reduced to 20% if, as is the case, Brussels is able to store a high level of supply (80%). However, if storage were to be reduced, European gas stocks would fall to 5% after the winter. This would not mitigate current demand.

"Falling storage to these levels would increase the risk of supply disruption in the event of a late cold snap," the report argues. "To maintain gas storage levels above 25% in the event of a lower LNG inflow, a reduction in EU gas demand during the winter period of 9% from the average level of the last five years would be necessary." "Gas saving measures will therefore be crucial to minimise storage withdrawals and maintain inventories at adequate levels until the end of the heating season," the agency concludes.