Oil and its geography

« On dit que l’argent n’a pas d’odeur : Le pétrole est là pour le démentir », Pierre Mac Orlan (multifaceted French writer)

The collapse in global oil demand has caused a massive fall in prices, forcing OPEC to negotiate a historic drop in production. This time everything is different. The current context combines a supply shock with an unprecedented fall in demand and a global health crisis.

Oil is undoubtedly one of the world's most desirable resources to the extent that it is often the cause of conflict. It was at the origin of the birth of industrial economies in the 19th century thanks to the property of containing a large amount of energy in a small volume that is easily transportable. For the last thirty years, oil has been competing with other sources of energy, and will continue to be an essential product in our daily lives for many years to come1.

"Oil is the biggest business in the world, and the main one of the big industries that have emerged in the last decades of the 19th century” - Daniel Yerguin2.

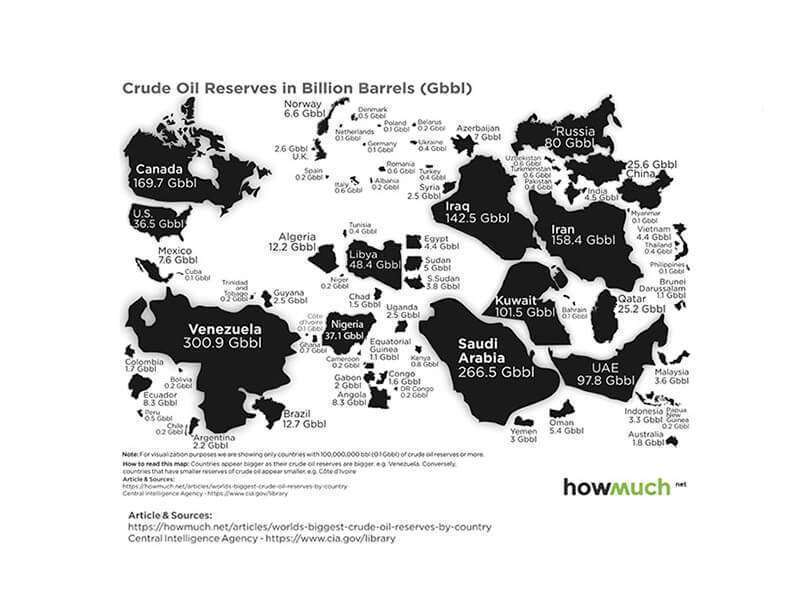

1. Oil reserves and where they are located

Source: https://www.cia.gov/library/publications/the-world-factbook

The top ten countries with the largest oil reserves are :

- Venezuela: 300.9 Gbbl3

- Saudi Arabia: 266.5 Gbbl

- Canada: 169.7 Gbbl

- Iran: 158.4 Gbbl

- Iraq: 142.5 Gbbl

- Kuwait: 101.5 Gbbl

- UAE: 97.8 Gbbl

- Russia: 80 Gbbl

- Libya: 48.4 Gbbl

- United States: 36.5 Gbbl

About half of the countries in the top ten are in the Middle East/North Africa region. Six of these countries (Venezuela, Saudi Arabia, Iran, Iraq, Kuwait and Libya) are members of OPEC (Organization of Petroleum Exporting Countries).

Interestingly, there is no clear correlation between the size of the country and its amount of oil reserves. For example, Kuwait, which has a land mass of 17,818 square kilometers, has 101.5 Gbbl in oil reserves; while Russia, which has a land mass almost ten times larger, has only 80 Gbbl in oil reserves. While oil products can make life and work easier, the costs to nature and the environment can be negative due to problems such as pollution and oil spills.

The varying amounts of oil reserves in each country can also lead to an imbalance in energy imports and exports. Given that the United States holds only about 36.5 billion barrels of the world's crude oil reserves and imports nearly 8 million barrels per day, finding alternative forms of energy is more important than ever4 .

According to current estimates, 79.4% of the world's proven oil reserves are in OPEC member countries, and most of them are in the Middle East, which accounts for 64.5% of the total.

OPEC member countries have made significant contributions to their oil reserves in recent years, for example through the adoption of industry best practices, intensive exploration and improved recoveries. As a result, OPEC's proven oil reserves stand at 1,189.80 billion barrels (2018).

2. The pandemic and the first decisions

The agreement of 12 April 20205

The energy ministers of the OPEC+6 alliance reached an agreement on Sunday, April 12, to support oil prices, an agreement that was joined for the first time by other producers with the US and Canada. Under the agreement, a production cut of 9.7 million barrels per day was established, ending the price war between Saudi Arabia and Russia7 and which, according to OPEC sources, could be double that amount with voluntary cuts inside and outside the cartel. This agreement is unprecedented in the extent of the announced production reduction in volume terms: almost 10 million barrels per day (b/d). It should be recalled that in 2019 world oil production was 100 million b/d. The agreement of 12 April 2020 therefore represents a reduction of 10 %. This has never been seen before.

The agreement is gradual in several phases. The maximum reduction - 9.7 million b/d - is planned for May and June 2020. Then, in the second half of 2020, the reductions are slightly less than 7.7 million b/d on the assumption that the economy will recover in the second half of the year and therefore lead to an increase in oil consumption. Finally, the third stage, from 1 January 2021 to 30 April 2022, the reductions in production would be reduced to 5.8 million b/d. (barrel day)

This is the first time that OPEC8 has reached an agreement over such a long period of time. OPEC decisions usually last a few months, never more than two years. This means that, at exceptional times, exceptional solutions. The current oil crisis is unique. There have already been sharp falls in prices, between the summer of 2014 and the beginning of 2016, in 2008, in the late 1990s or in 1986. But what is exceptional is that this crisis is marked by a very sharp drop in demand related to the coronavirus pandemic, which was not the case in previous years or at least not of this magnitude. This led the OPEC producer countries to reach an agreement in April, while some, such as Russia, rejected it in March.

Which countries will be most affected? Obviously it will be a very hard blow for some economies: I am thinking of Venezuela, Iran, Nigeria9 , Iraq, Angola, Algeria and some others. To give an example: 95% of Algeria's export revenues come from oil and gas10 . And the economic consequences will not be the same in a rich country like Qatar in Algeria or in Iraq, not to mention Iran or Venezuela which are under US sanctions.

This agreement, which, as I mentioned, will mean a drop in production of some 10 million barrels a day, will not be enough to raise the price in the face of a daily demand that is falling by at least 25/30 million barrels, according to estimates until the summer. And given that both the Russians and the Saudis have agreed to reduce their production, some experts do not expect them to make any further efforts.

Regulate prices, but this would require the Americans to join an OPEC ++11 by accepting quotas which, as we know, are against their principles.

In the Middle East, the countries are in principle very resistant to falling prices, their production cost is low (approximately 9 USD per barrel on average) especially in Saudi Arabia, but what will happen in this country with regard to the diversification and reform programme proposed by Crown Prince Mohamed bin Salman known as MBS?12 At the very least, there will be a delay in the implementation of his economic diversification plan known as the Saudi Arabia 2030 vision and this - as is usually the case in those countries highly dependent on their natural resources - due to the fact that it is a country that has been extremely dependent on oil for a long time.

In Africa, the impact will be even worse as the pandemic combines with a historic collapse of oil prices, putting pressure on state budgets and testing the resilience of the continent's most powerful energy companies. Prices appear to have reached their lowest level since 1991, and the immediate pressure on state budgets and macroeconomic stability is irreversible, as all producers in Africa had budgeted for 2020 with an oil reference much higher than $50.

3. How the oil market Works

The three biggest oil producers are: The United States, which ranks first, Russia and Saudi Arabia. Between them, they account for between a third and 40% of world oil production.

The oil market has two main modalities of negotiation:

The free market or "spot": Oil is a commodity whose price is determined by offer and demand. The offer comes from the companies that extract the oil. The demand comes from refiners who convert the crude oil into products that can be used by the final customers (fuels, combustibles, raw materials for the petrochemical industry). The refiners go through specialised commercial subsidiaries whose business is to intervene in the market to buy the quantities needed for the operation of refineries or to resell unused surpluses. These traders may also seek to make short-term profits through purchase and resale transactions by playing on daily price changes. For example, it is common for an oil shipment to change ownership several times before it is delivered. The market in which these physical oil barrel trading transactions take place, however, is called the spot market.

And the market for futures or "paper": In addition to barrels of oil actually changing hands, there are barrels of oil that are traded only "on paper". Oil is bought and sold "on paper" on the basis of an estimated future value and, as a rule, there is no physical exchange of the product. These transactions are carried out in the futures markets, the two main ones being the NYMEX (New York Mercantile Exchange), located in New York, and the IPE (International Petroleum Exchange), located in London. These transactions allow producers to sell futures (or refiners to buy futures) at a price set in advance, thus protecting against any unfavorable price variation.

Reference price and OPEC influence

There are many types of oil that differ according to their quality (viscosity, sulphur content, etc.) making them more or less easy to refine. Therefore, there are as many grades of oil quality as there are deposits in production.

Reference or benchmark prices13

The best-known types of crude oil that serve primarily as benchmarks for global prices are West Texas Intermediate (WTI), for oil produced in the United States; and Brent for North Sea oil. But there are others like the Dubai Fateh, for oil produced in the Persian Gulf; the Bonny Light in Nigeria or the Western Canadian Select, for heavy oil from the oil sands of Canada.

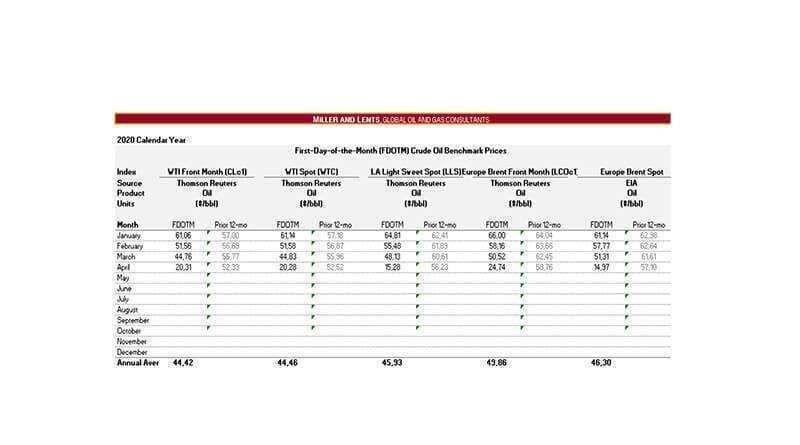

Crude oil prices are then determined on a deposit-by-deposit basis, with a bonus or discount, from a reference price. If WTI or Brent are the most privileged, it is not because of their quality, but because of their continuous quotation with numerous future sale or purchase deadlines in liquid markets. Today, only the New York and London markets are able to offer this service. As a result of the COVID-19 epidemic, demand decreased significantly, which led to a drop in prices. The price of WTI oil even became temporarily negative in April 2020 due to storage saturation in the United States.

There is also another reference price that is important to look at, which is the price of the basket of oil sold by the 13 members of the Organization of Petroleum Exporting Countries (OPEC) and which will influence the world oil market.

OPEC: a cartel which aims to regulate prices

The oil market is unique compared to any other market: oil volumes are openly manipulated by the world's largest exporters who have regrouped within OPEC. OPEC operates as a producers' cartel that seeks to regulate the price of oil through a coordinated effort by its members14 in which everyone has a share of production. At each meeting, they agree on the amount of oil to be exported and therefore influence the market price. However, there must be unanimity among the members as to the decision to increase or decrease oil production.

4. What has happened in the oil market?

"If you want to see an economist make a mistake ask him what the oil prices will be in the future"

We have witnessed an unparalleled drop in prices, which has led to the entry of negative crude oil prices in the month of April. The WTI, which is the type of oil used as a standard for crude oil pricing, has reached less than USD$ 40.32 a barrel, while the futures price in May (the one physically delivered) has been quoted at less than USD$ 37.63 a barrel, the lowest level historically. There was no better indicator of the magnitude of the economic damage caused by the coronavirus. With the closure of borders and the fact that a large part of the world's population remains confined today, transportation has practically been stopped.

Some expressions that are being heard...

- This is a pause (ExonMobil, Chevron Corporation)

- We have reached the peak of the price drop.

- We are on a plateau today... (BP,Shell) there will be levels of demand not so high, we will rather reach a flatter demand in the medium term.

Oil prices are rising, helped by industrial production in China and hopes of increased demand. Is this price increase sustainable?

As deconfinement continues to occur, the possibilities for movement and therefore transport increase. This will clearly lead to greater consumption of this raw material in its various versions. Is the worst over?

According to Gonzalo Escribano15 , "we are in a twin crisis of supply and demand: the initial price war between producers came at the worst moment, in the midst of a crisis of collapsing demand for the coronavirus; although later attempts were made to fix the situation with production cuts, these seem insufficient. At the moment, demand rules, and as long as the confinements do not end, we will not know to what extent demand can recover or to what extent. I believe that part of the destruction of demand will continue in the medium term, for example, teleworking will grow and reduce fuel consumption more than the trend towards private cars for fear of contagion can increase; business and tourist travel will be substantially reduced, including internal travel, as Google mobility data in all countries shows. The demand for jet fuel will take a long time to recover, if it does. Many analysts (including recently Shell and BP) believe that the coronavirus may have accelerated the peak in global oil demand by several years (expected a decade from now), although more than a peak would be a plateau at the current levels of around 100 million barrels per day".

5. What solutions would there be for the enormous amount of oil in stock?

Let us take the case of an oil producing and exporting country. The logical thing would be to slow down its production as much as possible and leave -since it is a raw material- this oil stored in the subsoil (underground). But once produced you have two options:

One: find a buyer with a price offer that interests you and sell it or a second one to leave it in storage waiting for better price offers. However, due to the high costs of storage and the limited capacity to absorb this unexpected magnitude of reserves, this could lead companies to dump the barrels at zero dollars. If the economic slowdown due to the coronavirus is prolonged (and it seems to be the case), they could even be forced to sell at negative prices. This has already happened. For the first time, prices were quoted below zero and the WTI barrel ended up closing at -37 dollars. This means that whoever wanted to sell an oil futures contract had to pay to get rid of the asset. Oil producers have been slower to cut back on production, which means there is excess. The usual storage sites are already full, hence the negative futures prices to clear the market. There is a limited capacity of storage tanks.

So because of the drop in demand, and because pumping has continued normally, the world is flooded with oil. The world's storage capacity is already at full capacity, and producers are having trouble finding room for production. Under normal conditions, oil companies store crude oil in storage tanks near production sites and the ports from which they export it. But demand has dropped so much that they even use tankers to store it. Storing it on these ships costs no less than US$30,000 a day, three times more than on land. Because of this, the value of WTI has fallen into negative territory.

The vice-president of the Mosconi Institute, Gerardo Rabinovich, who predicts that the consequences of this crisis will be reflected for several years, commented on this: "Perhaps these negative prices are the folklore of the day, but the reality is that the market is completely unbalanced. Storage stocks are so full that even if the pandemic is overcome and demand recovers, it will take several years to empty this storage and return to a balance between supply and demand".

6. What will be the impact of this crisis on the energy transition

Between 6 January 2020 and the end of March, the price of oil fell by 66%! And when oil is very cheap, it means that this energy source is even more competitive than before. And so this does not facilitate, but quite the opposite, the energy transition and the increase in non-carbon energy sources, whether renewable or nuclear. But as always in this market everything depends on supply and demand, but do demand and supply exist at the moment?

In short, a very sharp fall in the price of oil, as is the case at the moment, is not a good new. The energy transition is facilitated by high oil prices. This drop would not in theory help the aforementioned transition. The Arab countries are far behind in the energy transition, but what is happening today should serve as a warning to them in the future. (Algeria, Saudi Arabia)

The economy is a matter of supply and demand, production and consumption. The question for the post-pandemic economy17 is whether that balance, once lost, can be quickly restored. Doing so will be much more complicated than finding more places to store West Texas Intermediate oil.

As for the consequences, there is a lot of uncertainty for 2020. The oil crisis is the result of an economic crisis, which follows a health crisis.

Therefore, everything related to oil is directly related to global issues: what will happen to the world economy? When will it restart? The International Monetary Fund predicts a global recession of 3% in 2020. But if there is a recession for the whole year, will the recovery take place in the third quarter? Perhaps in the fourth quarter? How big will this recovery be? So, it is very difficult to be precise about the impact of this agreement on oil prices, the oil and energy sector by the end of 2020.

In any case, in most scenarios, oil and gas will remain a multi-billion-dollar market for decades. Given their role in providing affordable energy, their contribution is too important to fall.

The broader conclusion is that the COVID-19 crisis is an extraordinary deflationary shock to the economy causing the inactivity of a large part of the world's productive resources. There is no need to be confused by the scarcity of a few products. The consequences will almost certainly persist beyond the period of generalised suspension of activities.

Bibliographic references:

- Francis Perrin est Directeur de recherche à l'Institut des relations internationales et stratégiques (IRIS), chercheur associé au Policy Center for the New South, spécialiste des questions énergétiques. Arabie Saoudite, Irak, Venezuela... les pays exportateurs de pétrole fragilisés 40 minutes

- Christian Chesnot est journaliste à la Rédaction Internationale de Radiofrance.

- RichardJ.Barnet « The lean years Politics in the age of scarcity” editorial ABACUS

- Daron Acemoglu y James A. Robinson en “Porque fracasan los países”.

- Hocine Malti « Histoire secrète du pétrole algérien » Editorial La découverte

- Daniel Yerguin « The prize » Free press https://www.aurumbureau.com/es/speaker/daniel-yergin/

- Jared Diamond “Crisis” editorial Debate.

- Gonzalo Escribano documentos del Real Instituto el Cano.

- Energies Nouvelles Departement d’etudes économiques 11 mi 2020

- AOP Asociación española de productos petrolíferos

- Filipe Barbosa, Giorgio Bresciani, Pat Graham, Scott Nyquist, and Kassia Yanosek: Oil and gas after COVID-19: The day of reckoning or a new age of opportunity?

- David Rigoulet-Rozet rédacteur en chef de la revue "Orients Stratégiques".

- Consultas en Jeune Afrique, The Economist, Le Monde.

- France 24 https://www.france24.com/fr/20200514-coronavirus-la-fin-du-p%C3%A9trole-cher

Endnotes:

1-Crude oil is a mixture of hydrocarbons that were formed from plants and animals that lived millions of years ago. Crude oil is a fossil fuel, and it exists in liquid form in underground pools or reservoirs, in tiny spaces within sedimentary rocks, and near the surface in tar (or oil) sands. Petroleum products are fuels made from crude oil and other hydrocarbons contained in natural gas. Petroleum products can also be made from coal, natural gas and biomass.

2-Daniel Howard Yergin is an American author, speaker, energy expert, and economic historian.

3- Venezuela's oil reserves are enormous, ranking this country first, proven reserves, ahead of Saudi Arabia.

4-Gbbl occasionally for widest comprehensive statistics/units of volume billions of barrels. In the global oil industry, a barrel of oil is defined as 42 U.S. gallons, which is approximately 159 liters, or 35 imperial gallons.

5-The first objective of this agreement is to help stabilize the world oil market by reducing the surplus of supply over demand.

6- The Organization of Petroleum Exporting Countries and allies.

7-Russian oil giant Rosneft is going to reduce its investments by more than 20% this year due to the spectacular drop in oil prices due to the coronavirus crisis according to its president Gerhard Schröder.

8-The Organization of Petroleum Exporting Countries (OPEC) is an international organization founded in Baghdad, Iraq, in 1960. Currently it is made up of 14 countries, of which 5 are founding members (Saudi Arabia, Kuwait, Iran, Iraq and Venezuela). Since 1965 it has been based in Vienna, Austria.

9-First oil producer in Africa, Nigeria obtains 70% of its export revenues from its crude oil. With falling prices, revenue projections are revised downwards. The country is in trouble, justifying its dependence on the International Monetary Fund. As a result, that agency provided $3.4 billion to Nigeria as emergency aid. Ibrahim Jibrin, director of the Center for Democracy and Development in Nigeria, said he had long anticipated the problem, "as dependence on oil has been excessive for many years". But the Nigerian expert fears another problem. "Nigeria, in recent years, has been getting into excessive debt, especially through loans from Chinese banks, with difficulties in repaying that debt. And that will be a problem," he said.

10-The COVID-19 pandemic caused black gold prices to fall to historically low levels. This is a severe blow to the Algerian economy, which earns almost 95% of its export earnings and about three-quarters of its budgetary income from hydrocarbons. As a result, the decline in foreign exchange reserves is accelerating and the recession is deepening. The International Monetary Fund (IMF) expects gross domestic product to contract by 5.2 per cent by 2020. Algeria has not made any energy reforms in order to remain in the market. Furthermore, Algeria has a very delicate economic and political situation, with a very high public deficit of 20% and a public debt of 60%. Algeria must revitalise its energy sector because it is losing the market, it is leaving it alone because it has not changed its policies on production, distribution, in short, all its capacities. Sonatrach still does not have the capacity to move the rest of its economy. They should have their own refineries and not depend on the outside for that.

11- Confluence of interests between the United States, Russia and OPEC.

12- He is the one who directly manages the Public Investment Fund and the Aramco oil company: he has a fortune that exceeds 368 billion dollars.

13- Benchmarking consists of analyzing the prices of competitors with a clear objective: to understand the competitive position of one's own supply in relation to that of competitors. The concept of benchmarking refers, in the first place, to the study of competition in any area.

14- OPEC is made up of: Saudi Arabia, Iran, Iraq, Kuwait, Venezuela, Libya, United Arab Emirates, Algeria, Nigeria, Gabon, Angola, Equatorial Guinea and the Republic of the Congo. Together, these countries hold about 80% of the world's oil reserves, a number that reaches 90% for OPEC members.

15-Gonzalo Escribano directs the Energy and Climate Change Program at the Real Instituto Elcano and is a professor of Economic Policy in the Department of Applied Economics at the Universidad Nacional de Educación a Distancia (UNED).

16-If Libya were in the oil market today, the price of oil would perhaps be even lower than it is today.

17-A pandemic is the affectation of an infectious disease in humans over a large geographical area. The word comes from the Greek πανδημία, from παν (bread, everything) and from δήμος (demos, people), an expression that means the gathering of a whole people. Royal Spanish Academy and Association of Spanish Language Academies (2014).