The petroyuan and China's influence in the Gulf

Beijing threatens the dollar's hegemony in the global monetary system

The chip war, Taiwan or the global monetary system. The scenarios in which the new Cold War between China and the United States is played out are difficult, but the unseating of the greenback could be the checkmate move in the increasingly tense battle for world hegemony. And this scenario is playing out in Saudi Arabia, the world's leading oil producer.

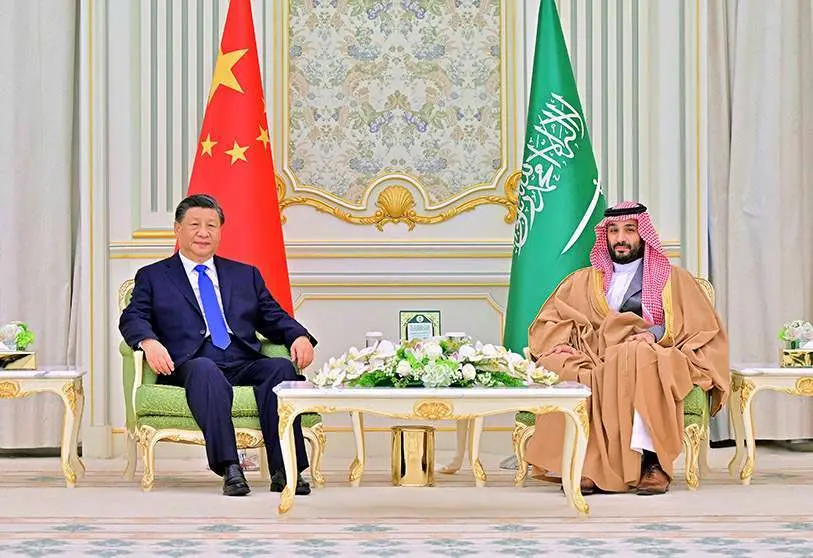

The influence that the Beijing regime has projected in the Gulf in recent years was sealed at the recent meeting in Riyadh on 9 December between Chinese President Xi Jinping and Saudi Crown Prince Mohammed bin Salman. A meeting of the Arab League and a summit between the Gulf Cooperation Council (GCC) countries marked a turning point in China's relations with Arab countries, which now boast the signing of a 'comprehensive strategic partnership' agreement. Something that the all-powerful Xi Jinping wanted to reflect: "China hopes to work with Saudi Arabia and the Arab states to turn both summits into milestones in the history of Sino-Arab relations and China's relations with the GCC, and raise these relations to new heights", the Chinese Foreign Ministry quoted Xi as saying.

But behind this announcement were many conditions set by Beijing that paid homage to the adjective 'comprehensive' in the agreement. The Chinese president assured that his country would continue to buy oil and liquefied natural gas "in large quantities", but with a slight hint: to do so in yuan, the Chinese currency, instead of the US dollar. First blow on the table.

China is the world's second largest economy, leading exporter and largest consumer of global oil. A powerful enough position to overcome the problem that only 10% of global transactions are accounted for in yuan. In fact, it has been five years since the policy to oust the greenback from the international economic scene began with the creation of the petroyuan.

In 2017, the People's Bank of China and the Central Bank of the Russian Federation agreed to carry out oil transactions in the Chinese currency through the platform of the Shanghai Oil and Natural Gas Exchange, the first step towards converting the yuan into a petrocurrency. The second is to buy 32 tonnes of gold to bolster the value of the renminbi - literally, the people's currency - and make it a true reserve currency, as the Politburo did in November 2022.

Paying in yuan for the black gold was a request that was also extended to Iran and Venezuela, and now to all GCC countries: Saudi Arabia, Kuwait, the United Arab Emirates, Bahrain, Qatar and Oman. In return, China pledges to increase its purchase of oil and liquefied gas, more than the 25% it already imports from Riyadh.

No sooner said than done. China's new Foreign Minister Chen Gang has insisted over the past week on strengthening economic ties with Saudi Arabia and creating a free trade zone between China and the Gulf region as soon as possible. This was conveyed by the new Chinese Foreign Minister to his Saudi counterpart, Prince Faisal bin Farham.

Until Xi Jinping's latest moves, few had questioned the dominance of the US dollar as the undisputed currency of world trade, but the Chinese leader's latest meeting with the Saudi crown prince follows exactly the same steps that the United States took to achieve its currency's current status. In 1945, President Franklin D. Roosevelt met with Saudi King Abdul Aziz Ibn Saud aboard the USS Quincy, where it was agreed to fix oil transactions in dollars.

The agreement gave Washington undeniable privileges. It was the sole issuer of the currency, obliged all countries to keep reserves if they wanted to trade on the international market, facilitated the financing of public deficits, controlled payments through the SWIFT system and, above all, had the capacity to freeze the assets of any country considered hostile, as Jesús Sánchez-Quiñones points out in the business daily Expansión.

However, this geopolitical alliance, one of the most important of the century, now seems to be faltering. The total foreign exchange reserves of IMF member nations were 72% in 2000, and by 2021 had fallen to 59%. For the chairman of the Federal Reserve System (FED) himself, Jerome Powell, the dollar could share the limelight with the yuan in the medium to long term. For Chinese propaganda, the de-dollarisation of the economy is already a fact.

All that remains is for Xi Jinping to follow in Nixon's footsteps and force Riyadh to buy Chinese Treasury bonds with the yuan it obtains from oil sales, as Washington agreed in a secret pact in 1973.

For the BRICS group (Brazil, Russia, India, China and South Africa) the use of the yuan has indisputable advantages. Firstly, one yuan is equivalent to approximately 0.14 euros. Transactions through the Chinese currency would lower costs and attract more investment to China following the lower energy prices. Second, because it provides an escape route from Western sanctions.

Venezuela, Iran, Yemen, Cuba, Burundi, North Korea, Somalia, Libya are some of the countries on the long list of OFAC, the Office of Foreign Assets Control. This division of the US Treasury Department is possibly the most important weapon the White House has at its disposal in economic matters because it allows it to apply economic and trade sanctions based on Washington's foreign policy, as long as the global market is governed by the dollar.

All countries deemed hostile to national security are subject to sanctions. It is true that this policy has been in place for decades, but Russia's invasion of Ukraine has brought economic sanctions to the forefront of the media. It was the West's first reaction, the harshest punishment to date against Moscow and a good solution to avoid World War III.

However, it is also a double-edged sword. Using the Chinese currency is to cushion economic sanctions, including the latest EU blockade of 300 billion euros ($326.73 billion) on Russian central bank reserves. Using the yuan would then mean moving out of the US sphere of influence that would impact on the dollar's monopoly as the international currency of value. "It is as if the United States could have fallen into a trap, because by isolating Russia it is in reality renouncing its formidable influence", Carlos Esteban published in La Gaceta de la Iberosfera. Petroyuan's final blow.

The United States did not only base its agreements on the purchase of oil. Behind it was a network of protection and armaments that guaranteed the Gulf state's security in the region for the past 70 decades. China took note and doubled down. Xi Jinping promised Mohammed bin Salman an "all-encompassing" partnership, including, in addition to security, cooperation in technology, transport, energy, and participation in the New Silk Road.

"Xi's visit to Riyadh is a new nascent alliance of China and all GCC countries. The agreements transcend oil. It is a synergy between the Belt and Road and Saudi Vision 2030. It is a long-term project, but with firm foundations', says Raúl Ramírez Ruiz, a historian specialising in China and professor at the Universidad Rey Juan Carlos, in a conversation with Atalayar.

The requirements in exchange were not many. Beijing only asked for the key to its geopolitics: the principle of "One China". On 9 December, Mohammed bin Salman agreed: "Saudi Arabia supports Beijing in protecting its sovereignty, security and territorial integrity, and also supports Chinese measures and efforts to de-radicalise". New Chinese conquest.

However, Xi Jinping is not the only one to have visited Riyadh in recent months. Joe Biden did the same in the summer of last year during an official tour of the Middle East, when there was the very staged photograph of the coldness between the Saudi prince and the Democrat who called him a "pariah" during his election campaign over the Jamal Khashoggi case.

An interference in Saudi Arabia's internal affairs that Mohammed bin Salman would not forgive and which in turn brought him closer to China's sphere of influence. "China's advantage is its foreign policy based on the Beijing Consensus of non-interference in the internal affairs of others. The United States does," says the historian. One more reason why Biden's visit was not as successful as that of the Chinese president, besides the fact that he did not bring as many proposals to the table.

In October, it was the Saudi prince who made a move. OPEC+, led by Saudi Arabia, announced that it would cut its oil production by two million barrels per day, a decrease that favoured Russia in order to cover the cost of its invasion. The oil cartel's decision set off alarm bells in the Oval Office, where Joe Biden said they would reassess the relationship with the Gulf state.

Days later, the Democratic leader declared in an interview with CNN that Saudi Arabia would have consequences: "I'm not going to go into what I'm weighing and what I have in mind. But there will be, there will be consequences," Biden said. Saudi Arabia's decision was undoubtedly a setback for the relationship between the two countries because it distanced itself from the decades-long barter of US security and arms in exchange for cheap oil.

The rift between the two countries was exploited by China. US State Department spokesman Vedant Patel was asked about Xi Jinping's trip. "We are not telling countries around the world to choose between the United States and the People's Republic of China," Patel responded in what was perhaps already a sign of weakness.

China's influence in the Gulf is already cast. It certainly does not represent a change in the world order, but only for the time being. "China has the strength to supplant the great hegemon because it has the capacity to plan for the very long term and because it leads an anti-American bloc in which the GCC oil producers are now united", says historian Raúl Ramírez Ruiz.

The implementation of the petroyuan threatens the dollar as a common currency on the international market in the medium and long term, and this is already another reality that adds to the West's problems of insomnia.