Prospects for the global economy and for Spain in 2022

Spain is facing a very similar scenario to that of the Eurozone

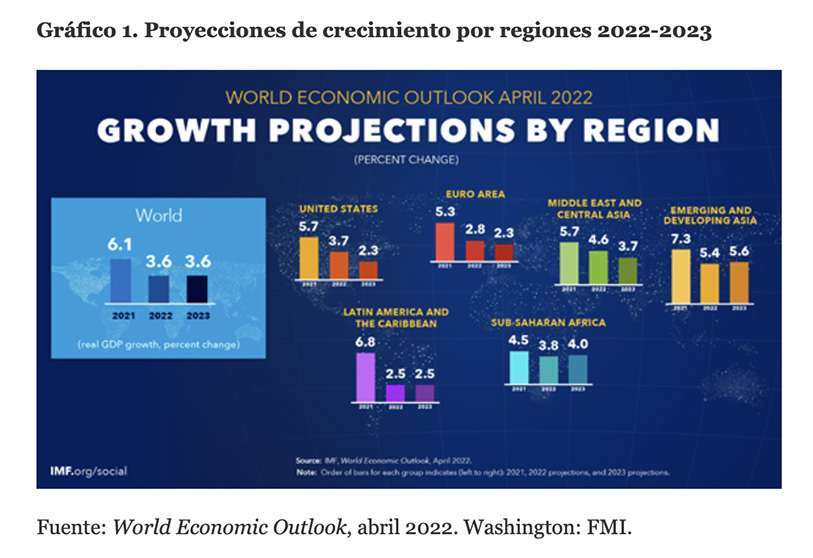

The IMF acknowledges in its World Economic Outlook (WEO) published on 19 April that the economic recovery has slowed significantly since the last report published in October 2021 and the update of this report presented in January 2022. In both the October report and its January update, the IMF estimated world economic growth at 5.9% in 2021, but lowered the 2022 growth projection to 4.9% in the October report and 4.4% in the January update. The April report raised growth in 2021 to 6.1%, 2 tenths of a percentage point higher than in the two previous reports, but lowered the growth projection for 2022 to 3.6%. By major regions, the projected growth figure for the Eurozone as a whole in 2022, 2.8%, only exceeds that of Latin America and the Caribbean, 2.5%.

In the update published in January 2022, the IMF acknowledged that the recovery had been slowed by several factors. Firstly, it highlighted the huge surge in infections caused by the Omicron variant of the COVID-19 virus in the last quarter of 2021 that forced authorities in many countries to adopt new mobility restrictions, caused countless sick leave and resulted in 7,000 deaths per day on average in the last three months of 2021. Figure 2 shows the evolution of the number of daily cases counted globally and illustrates the significant increase in cases in the last months of 2021 and early 2022, a development that affected even those countries that had made the most progress in the vaccination process.

A second factor negatively affecting output growth was the disruptions in supply lines caused by the pandemic itself, which led to shortages of intermediate goods that hit the manufacturing sector in the United States and the EU particularly hard. By mid-September 2021, it was estimated that the semiconductor shortage could reduce the number of cars produced in 2021 by 7.7 million, almost double the estimate of 3.9 million units advanced in May. The reduction in revenue from the drop in production in the automotive sector alone was put at $210 billion. In the United States, the car shortage led to a sharp drop in sales and inventories in the second half of 2021, as well as an increase in prices paid by consumers to purchase light vehicles. In the case of China, the effects of the pandemic should be added to the disruptions caused by the shortage of energy sources and the resulting supply disruptions that have had a major impact on companies producing consumer and export goods.

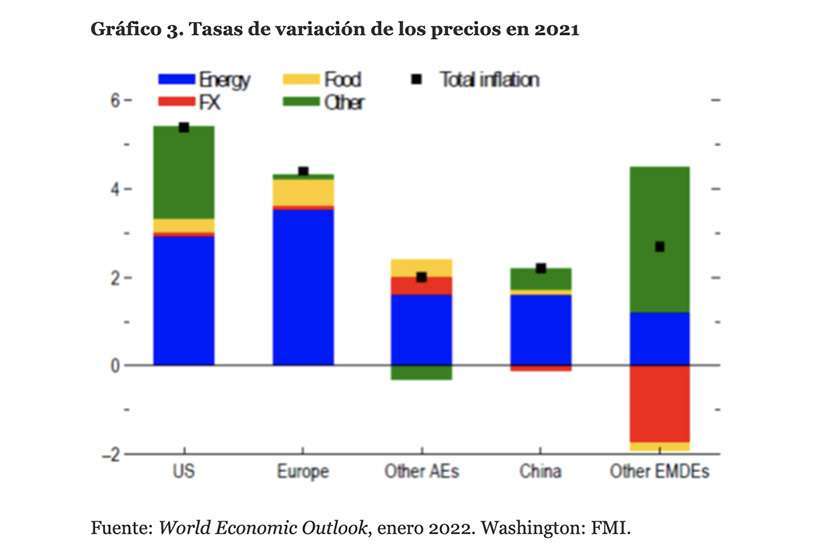

In the third place, it is worth mentioning the increase in inflation rates in the second half of 2021. As can be seen in Figure 3, the sharp rise in prices in the United States can be attributed to rising energy prices (blue area) on the one hand, and rising demand for goods combined with the aforementioned supply problems (green area) on the other. In the case of the EU, the increase in prices in 2021 is mainly due to the sharp rise in energy prices and, to a lesser extent, to higher food prices (yellow area) and disruptions in production.

Finally, the slowdown in growth in the second half of 2021 is not unrelated to the anticipated change in the monetary policy stance in advanced economies to curb the rise in the inflation rate in 2021. At its meeting on 26 January 2022, the Federal Open Market Committee (FOMC), while acknowledging its dual commitment to "promote maximum employment and price stability", warned that it considered the increase in the federal funds rate "its primary tool for adjusting the stance of monetary policy", and communicated its intention to "reduce its holdings of assets over time in a predictable manner by adjusting the amounts reinvested" at maturity.

At the OMC meeting on 26 March, the cost of federal funds, which had remained unchanged since March 2020, was raised from 0.25% to 0.5%. Although the inflation rate in the Eurozone in December 2021, 5.0% , was more than double the inflation target of 2%, the ECB was more cautious and at the Governing Council meeting on 16 December "decided to discontinue the Pandemic Emergency Purchase Programme" (PAPP) in March 2022, but maintained the commitment to reinvest the principal of maturities as they fall due until the end of 2024. In addition, the ECB remained committed to continuing its Asset Purchase Programme (APP) until at least the third quarter of 2022 and to keeping key interest rates unchanged "until some time after the Governing Council ends net purchases under the umbrella of the APP.

While the changes to the monetary policy stance are too modest and gradual to have a significant impact on growth in 2022, they certainly add to the uncertainty for already beleaguered consumers and investors who have yet to recover from the ravages of the pandemic. The room for manoeuvre for some countries such as Spain, whose governments have been unable to contain transfer programmes and other current spending and have accumulated massive public debt since 2007, is rather slim as they face a period of lower liquidity and higher interest rates. Over the last few years, we have been kept afloat by low rates and the ECB's asset purchase programmes, but the likelihood of finding ourselves back in a situation similar to the one experienced in 2012 is not negligible. And, despite the gravity of the situation, our political leaders are still locked in their reverie, some advocating increased 'social' spending and others cutting taxes.

The disruptions in production caused by the pandemic and the energy crisis were, as we have just seen, the main causes of slowing global growth and rising inflation in the second half of 2021, and they continued to exert this negative influence during the first weeks of 2022, before Russia invaded Ukraine on 24 February. There is no doubt that the criminal war unleashed, and the sanctions imposed on Russia by Western countries will have devastating effects on Ukraine, very negative effects on Russia, and negative effects on the EU. The US will not fare so badly and may even increase its energy and non-energy exports to the EU as a result of the war.

The first three columns of Table 1 show the output growth rate in 2021 and growth projections for 2022 and 2023 for advanced, emerging and developing economies. The next two columns present the growth projections published in the January 2022 WEO update, and the last two columns identical to the information in the October 2021 WEO. As can be seen between January and April 2022, the IMF has lowered global growth in 2022 by 8 tenths of a percentage point, from 4.4% to 3.6%, after having already lowered it by 5 tenths between October 2021 and January 2022. We do not know exactly what fraction of the latest 8 tenths reduction can be attributed to the invasion of Ukraine, but given that the three factors (pandemic, production disruptions and energy crisis that led the IMF to cut the growth projection by 5 tenths in January 2022) were still active in 2022, it seems reasonable to attribute to these same factors, not the invasion per se, between 3 and 5 of the 8 tenths by which the IMF cut the global growth projection in April.

This conclusion is reinforced by examining the cuts in the disaggregated growth projections for individual regions and countries. Of course, negative signs indicating cuts in growth projections for most countries in both October 2021 and January 2022 dominate overwhelmingly, with no exception found for advanced economies. These cuts are extraordinarily high for Russia, the only country among those singled out in Table 1 whose GDP will be severely cut in 2022. Moreover, there are significant cross-country differences in the magnitudes of the revisions in October 2021 and January 2022 that are useful for gauging the impact of Ukraine's invasion on economic growth.

Projected growth for the United States in April 2022 is 1.5 percentage points lower than in October 2021, but only 3 tenths of a percentage point lower than projected in January 2022. A similar comment can be made about China whose growth projection was reduced by 8 tenths of a percentage point from October 2021 to January 2022 and by only 4 tenths of a percentage point between January and April 2022. It can be concluded from this that the consequences of the invasion of Ukraine have been of a minor order for both countries. At the opposite extreme is Russia, a country for which the IMF projected GDP growth of 2.9% in October 2021 and 2.8% in January 2022, but which now anticipates a severe contraction of 8.5%. The invasion of Ukraine has dramatically changed the outlook for the Russian economy in 2022. The case of Ukraine, as might be expected, is even more disturbing: the IMF projected in October a GDP growth of 3.9% in 2022 that has turned into a brutal fall of 35.0% in the WEO published in April. A veritable economic cataclysm whose effects will be felt for decades in the living standards of those Ukrainians who survive the war. I cannot help but wonder whether President Zelenski weighed up the dramatic consequences of his decisions.

The IMF has also reduced the 2022 growth projection for the Eurozone, from 4.3% in October 2021 to 3.9% in January 2022, and to 2.8% in April 2022. Possibly in this case, slightly more than half of the 1.1 percentage point reduction between October and April can be attributed to the pandemic, the disruptions in production and the energy crisis already underway before the invasion (4 tenths between October and December and 3 tenths more between January and April), and the rest (6 tenths) to the disruptions caused by the war on gas, food and fertiliser supplies from Russia and Ukraine, and to the fall in exports of goods and services from the Eurozone to these two countries.

In the case of Spain, the outlook is very similar to that of the Eurozone as a whole. The IMF anticipated GDP growth in 2022 of 6.4% in the October 2021 projections, which was reduced by 6 tenths of a percentage point to 5.8% in January 2022, and by a further 1 percentage point in April 2022, to 4.8%. A negative impact of around 5-6 tenths of a percentage point of GDP can be attributed to the invasion of Ukraine, while the rest of the cut in the growth projection for 2022 should be attributed to the three aforementioned factors that had already lowered growth projections by 6 tenths of a percentage point in the second half of 2021, long before the invasion of Ukraine was anticipated and consummated.

Our politicians have seized on the invasion of Ukraine to blame it for almost all our present and future ills, and thus minimise their responsibility for the ineffective management of the pandemic and the energy crisis in 2020 and 2021. As I have argued in the articles published in this newspaper in the last two weeks ("Electricity prices and government policies I" and "Electricity prices and government policies II"), the green transition policy implemented unilaterally by the EU and the diplomatic blunders incurred by the European institutions and the Spanish government with Russia and Algeria, two key countries for securing gas supplies to the EU and Spain, are mainly responsible for the increase in energy prices.

In the latest WEO in April, the IMF acknowledges that "even before the war, inflation had spiked in many economies because of higher prices for some commodities and pandemic-induced supply-demand mismatches". In the same vein, a World Trade Organisation (WTO) press release issued on 12 April acknowledged that "the war in Ukraine is not the only factor dragging down world trade at the moment". So to God what belongs to God and to Caesar what belongs to Caesar. To reiterate what has been said. On 16 October 2021, I published another article entitled " General State Budget 2022: very optimistic forecasts" in which I analysed in detail the macroeconomic picture that the Spanish Government was using to support its accounts. Specifically, the government assumed that GDP would end 2021 with a growth rate of 6.5% and would grow even more, 7%, in 2022. My analysis suggested that growth in 2021 would be at most 5.5% and warned that the government's optimistic growth forecast for 2022, 7%, lacked any basis as the IMF had already lowered the figure to 5.8%.

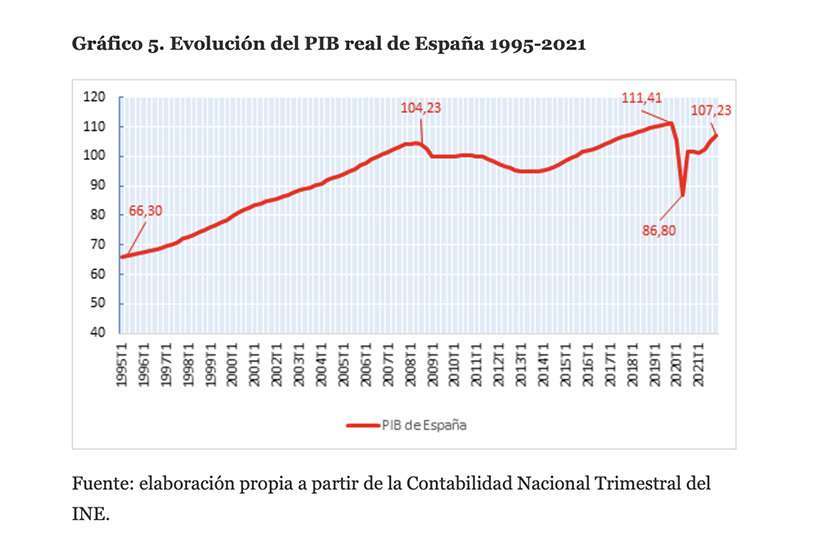

The latest GDP growth projection for Spain in 2022 is, as noted above, 4.8%, 2.2 points lower than the one set out in the government's PGE presented in October 2021. So even granting that the growth projection for Spain in 2022 is 2 percentage points higher than that of the Eurozone as a whole, 2.8%, the management carried out by the government headed by Sánchez in the last three years is not something to boast about. The GDP of the Spanish economy in 2021 as a whole was 6.25% lower than the GDP of 2019 and 2.08% lower than the GDP of 2018. We produced considerably less in 2021 than in 2019 and 2018, but our public debt at the end of 2021 was 218,374.6 million higher than at the end of 2018. You will judge whether these figures deserve a B or a B-minus. Here are a couple more graphs to invite you to reflect on this.

Article published by the Economic and Social Observatory of Catalonia (OBESCAT) in the newspaper El Liberal on 23 April 2022.