France approaches United Arab Emirates to reduce its dependence on Russian oil

The arrival of the sixth European package of measures against the Russian economy, adopted last Thursday, has also put many EU countries on the ropes. The decision to reduce the Kremlin's oil imports by nearly 90% over the next six months puts on the table, among other issues, the need to find new suppliers of oil and natural gas.

With some of the world's largest hydrocarbon reserves, the Gulf states have become, for many European powers, one of the main candidates to replace Russia. The French Republic has already taken the first steps in this direction by "looking for alternatives to gas and diesel imports from Russia," said Bruno Le Maire, the French Minister of Economy, Finance and Recovery.

"For example, the United Arab Emirates could be a solution, at least temporarily, to replace Russian oil and diesel. These are discussions that have already begun with the UAE," Le Maire added in an interview for CNews and Europe1 Radio. A rapprochement that could further improve relations between the two powers.

In economic terms, Abu Dhabi is France's second most important partner in the Gulf region, behind only Riyadh. The alignment of their positions on many Middle Eastern issues, as well as the convergence of interests in countries such as Libya, Mali and Somalia, have allowed France and the UAE to strengthen their ties, and the establishment of commercial relations based on the purchase of military aviation has only strengthened them.

These talks between Paris and Abu Dhabi followed the decision by OPEC+ members to increase oil production at the end of last week. Faced with the dilemma of maintaining tight oil production - set at 400,000 barrels per day - or negotiating a new increase to alleviate the ever-increasing cost of all raw materials, the organisation decided to "bring forward the global production adjustment scheduled for September". As a result, crude oil production in July and August will reach 648,000 barrels.

Now, despite doubts over whether the UAE will increase its exports or simply change the balance of quotas among its customers, France's objective remains clear: to ensure that Emirati oil flows reduce its dependence on Russian crude and diesel. And, at the same time, for these hydrocarbons to see their price rise slow down. In February, for the first time since 2014, the price of a barrel of Brent crude exceeded 100 dollars, and today, four months later, it remains above 115 dollars.

For his part, French President Emmanuel Macron has argued that the battery of sanctions imposed by the EU and the measures taken individually by almost all member states will cause Russian oil exports to fall by 92% by the end of the year.

"We must also get rid of Russian gas. We must regain our (energy) autonomy as soon as possible, because Vladimir Putin does not like the European project," EU internal market commissioner Thierry Breton warned in a parallel statement to CNews and Europe1 Radio, according to Boomberg. "For years, Putin has done everything he can to divide Europe. Now he is using gas precisely to divide us".

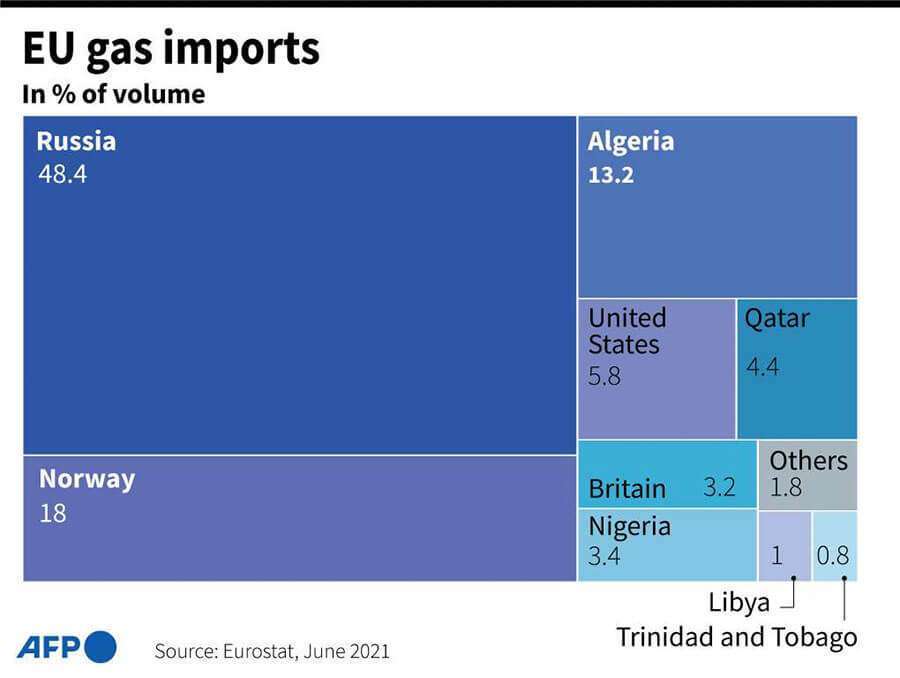

However, while European sanctions against Russian gas have not been ruled out for the time being, discontent and growing disagreement within the EU over condemnations of Moscow seem to cast doubt on any progress. Moreover, logistical obstacles in the search for new suppliers make the end of gas dependence on Russia even more distant.

"At the moment we are trying to maximise production. But in the short term the volumes that the Russians send to Europe cannot be replaced by liquefied gas because the structures are not sufficient," explains, for example, Anatol Feygin, one of the leaders of Cheniere Energy, which is among the leading US companies in liquefied natural gas exports.