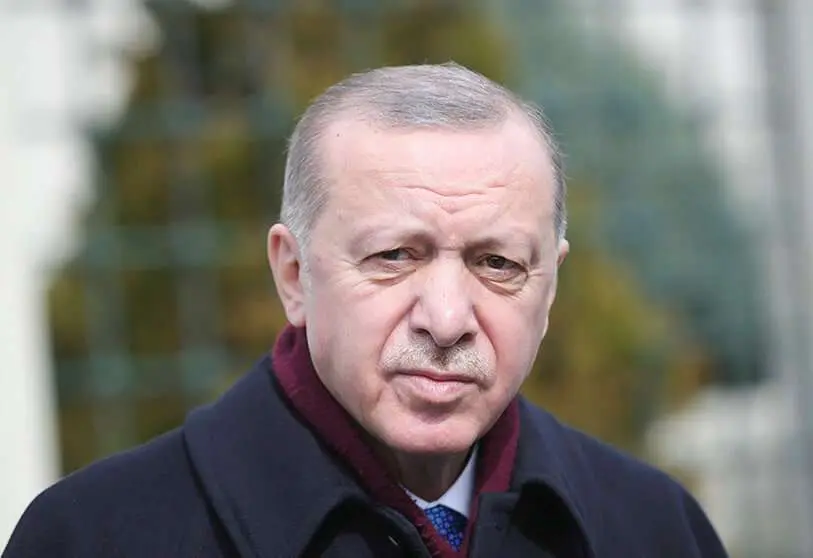

Turkey's lira plunges after central bank chief sacked

Last night, the Turkish lira plunged as much as 15 per cent after markets opened following President Erdogan's controversial decision to oust former central bank governor Naci Agbal. Following the dismissal, Erdogan appointed as the new governor a finance doctor and former AKP deputy, Sahap Kavcioglu, known for his conservative, pro-government views.

The former governor's dismissal followed the decision to raise interest rates to 19 percent, a decision that ran counter to the views of Erdogan, who has always been highly critical of such economic policies. However, Agbal's policy of curbing inflation had been applauded by the financial markets after making the Turkish lira the best currency for the "carry trade", a strategy used in the foreign exchange market.

After the opening of the markets, the currency fell to a very fragile level, with the exchange rate of one euro to one dollar at 9.3 and 7.8 liras, respectively, compared to 8.6 and 7.2 liras on Friday. On Sunday, the new governor pledged to take the necessary measures to combat inflation, saying in a statement that "the Central Bank of Turkey "will continue to use the monetary policy tools effectively in line with its main objective of achieving a permanent fall in inflation". Inflation has been characterised by double-digit stagnation for most of the last four years.

According to EFE, the Istanbul Stock Exchange opened Monday with a loss of 6.6% as a result of the governor's dismissal and suffered two technical blockages that prevented the stock market from functioning normally for more than an hour and a half.

Several banks, including Goldman Sachs, were already predicting a sharp fall in the lira and Turkish assets due to the president's critical views on high rates. Kavcioglu has been sympathetic to these detractions and has embraced Erdogan's views in which, according to the president, high rates "indirectly lead to higher inflation".

Shortly after Agbal's dismissal, investors told Reuters that they had been working over the weekend to predict how drastic and rapid the rate cut would be and how much the currency would fall back with the new appointment. According to Arab News, the heads of some local treasury offices had estimated bids as of 8 a.m. on Monday. Similarly, Kavcioglu said that any change in policy would be directly dependent on reducing inflation, which is the main objective of his policy.

Goldman Sachs, informed its clients that it would be reviewing investment recommendations and predicted a "discontinuous" fall in the lira and an "anticipated" cycle of rate cuts. According to the bank, Turkish banks spent more than 100 billion dollars to support the lira.

In this context, concerns about the central bank's lack of independence are growing in emerging markets. One of these would be Argentina as the dollar was up 0.17% against the six major world currencies. With the fall of the lira, external trade will be affected vis-à-vis competing countries, especially Brazil.

According to economists, Turkey has pursued an unorthodox and interventionist policy in the economy which has caused the lira to lose half of its value since the currency crisis of 2018.

This precarious economic situation suffered by the Turkish country has a direct link between Erdogan's ideas contrary to those of economists and his conservative and authoritarian decisions on the control of the Central Bank and its functioning. Now, with the replacement of the head of the Central Bank by Kavcioglu, who is in line with the conservative ideas of the Turkish government, it seems that the economic situation in Turkey will continue to decline unless Erdogan decides to listen to the advice of both national and European economists and decides to delegate the Bank's functions to try to get out of this worrying crisis that is beginning to have direct consequences on international and emerging markets.